Table of Contents

- Introduction: Freedom Meets Growth in 2025’s CD Market

- What Are No-Penalty CDs? The Complete Breakdown

- Best No-Penalty CD Rates July 2025: Comprehensive Comparison

- 2025 Market Analysis: Why Now Is the Right Time

- Who Should Consider No-Penalty CDs in 2025?

- No-Penalty CDs vs. Alternatives: Complete Comparison

- How to Choose the Best No-Penalty CD for Your Situation

- Opening Your No-Penalty CD: Step-by-Step Guide

- Tax Implications for American and Canadian Savers

- Frequently Asked Questions About No-Penalty CDs

- Expert Strategies for Maximizing No-Penalty CD Returns

- Looking Ahead: No-Penalty CD Outlook for Late 2025

- Conclusion: Smart Savings for Uncertain Times

Introduction: Freedom Meets Growth in 2025’s CD Market

Picture this: You’ve finally built up a solid emergency fund, but it’s sitting in a savings account earning a measly 0.5% APY. You want better returns, but traditional CDs feel too restrictive—what if you need that money unexpectedly?

No-penalty CDs solve this exact dilemma. In 2025, these flexible certificates of deposit are offering competitive rates up to 4.34% APY while maintaining the liquidity you need for life’s unexpected moments.

For American and Canadian savers seeking the perfect balance between growth and accessibility, no-penalty CDs represent one of the most compelling savings vehicles available today.

What Are No-Penalty CDs? The Complete Breakdown

Definition and Core Features

A no-penalty certificate of deposit (CD) is a time deposit account that allows you to withdraw your principal and earned interest before the maturity date without paying early withdrawal penalties. Unlike traditional CDs that lock your money away for months or years, no-penalty CDs provide an escape hatch.

How No-Penalty CDs Work

The Basic Process:

- Deposit funds with a minimum amount (typically $500-$1,000)

- Lock in a fixed APY for the specified term

- Wait 6-7 days after opening (standard waiting period)

- Withdraw anytime after the waiting period without penalties

- Earn guaranteed interest until withdrawal or maturity

Key Advantages for 2025 Savers

- Fixed rates ranging from 3.40% to 4.34% APY

- FDIC insurance protection up to $250,000

- Flexibility to access funds for emergencies

- Rate protection against potential Fed rate cuts

- No monthly fees at most institutions

Best No-Penalty CD Rates July 2025: Comprehensive Comparison

Based on our analysis of data from Bankrate, NerdWallet, and official bank websites, here are the top no-penalty CD rates available to American and Canadian savers:

Top-Tier Options (4.00%+ APY)

| Bank | APY | Term | Minimum Deposit | Withdrawal Rules |

|---|---|---|---|---|

| Climate First Bank | 4.34% | 6 months | $500 | After 6 days |

| Synchrony Bank | 4.25% | 11 months | $0 | After 7 days |

| Marcus by Goldman Sachs | 4.00% | 7 months | $500 | After 7 days |

| Marcus by Goldman Sachs | 4.00% | 11 months | $500 | After 7 days |

| Ally Bank | 4.00% | 11 months | $0 | After 6 days |

Competitive Mid-Tier Options (3.50%+ APY)

| Bank | APY | Term | Minimum Deposit | Special Features |

|---|---|---|---|---|

| Marcus by Goldman Sachs | 3.90% | 13 months | $500 | Extended term option |

| Bank of America | 3.51% | 12 months | $1,000 | Branch access available |

| CIT Bank | 3.50% | 11 months | $1,000 | Online-focused platform |

Rates current as of July 2025. All banks listed are FDIC-insured. Rates subject to change.

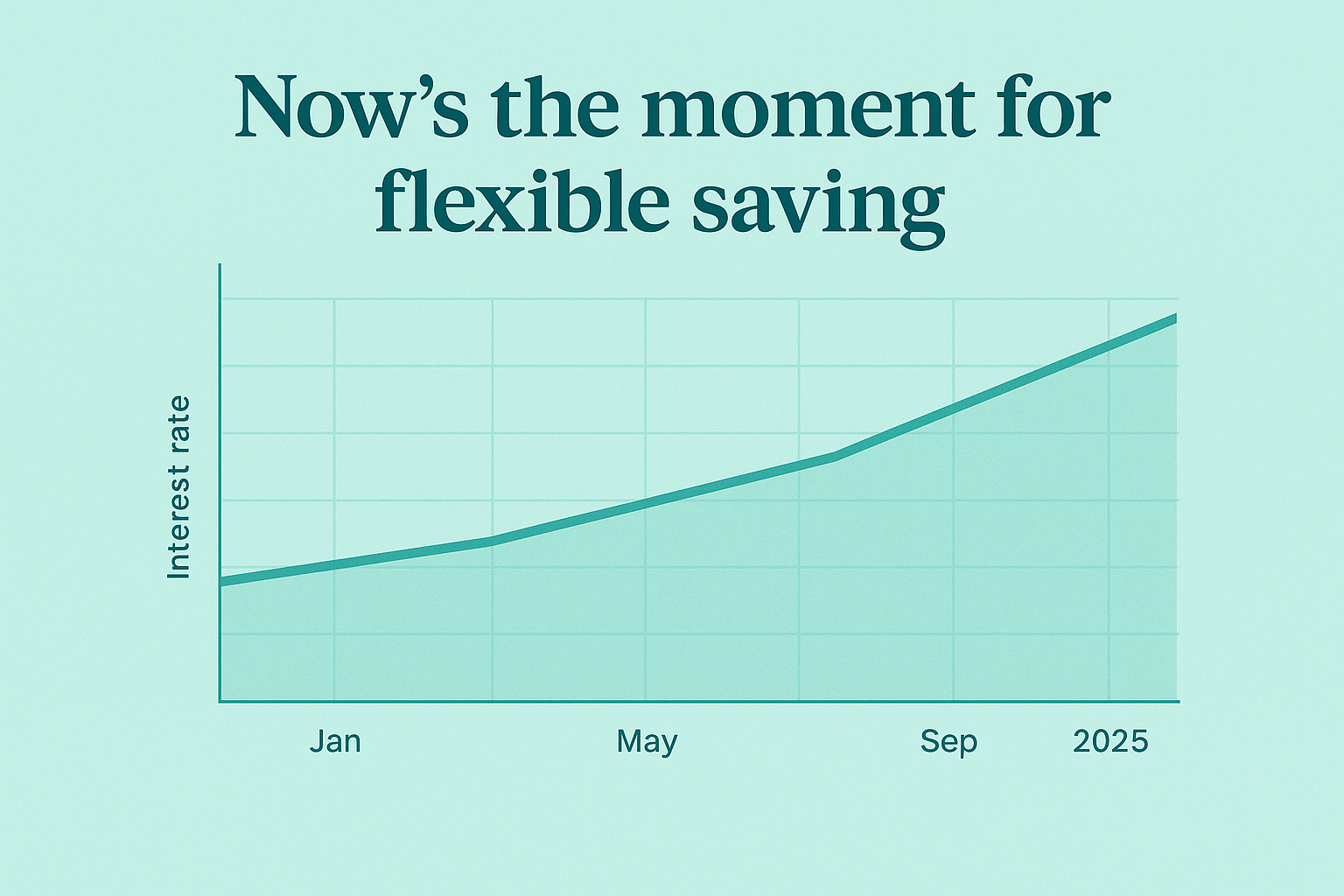

2025 Market Analysis: Why Now Is the Right Time

Federal Reserve Rate Environment

The Federal Reserve has maintained a cautious approach in 2025, keeping rates relatively stable after the cuts of late 2024. This creates a unique opportunity:

- Current rates remain attractive compared to traditional savings accounts

- Rate protection against potential future cuts

- Inflation hedge with APYs still above current inflation rates

Competitive Landscape Advantages

For American Savers:

- No-penalty CDs offer 2-3x higher returns than average savings accounts

- FDIC protection provides government-backed security

- Tax advantages with interest reported annually, not monthly

For Canadian Savers:

- Cross-border banking options available through major US institutions

- Currency diversification opportunities

- Competitive rates compared to Canadian GIC options

Who Should Consider No-Penalty CDs in 2025?

Ideal Candidates

Emergency Fund Optimizers

If you maintain a 6-month emergency fund in a low-yield savings account, no-penalty CDs can boost your returns by $200-400 annually on a $10,000 balance while maintaining accessibility.

Conservative Investors

Market volatility concerns many investors in 2025. No-penalty CDs provide guaranteed returns without stock market risk, making them perfect for risk-averse savers.

Rate Environment Hedgers

With potential Fed rate cuts on the horizon, locking in today’s rates while maintaining flexibility positions you advantageously for changing economic conditions.

Real-World Example: Sarah’s Strategy

Sarah, a 34-year-old marketing manager from Denver, had $15,000 in a savings account earning 0.5% APY. By moving to a Climate First Bank no-penalty CD at 4.34% APY, she’ll earn an additional $576 annually while maintaining emergency access to her funds.

No-Penalty CDs vs. Alternatives: Complete Comparison

No-Penalty CDs vs. High-Yield Savings Accounts

| Feature | No-Penalty CD | High-Yield Savings |

|---|---|---|

| Interest Rate | Fixed (3.40%-4.34%) | Variable (3.50%-4.50%) |

| Rate Stability | ✅ Guaranteed | ❌ Can decrease |

| Accessibility | After 6-7 days | ✅ Immediate |

| Additional Deposits | ❌ Not allowed | ✅ Unlimited |

| FDIC Insurance | ✅ Yes | ✅ Yes |

No-Penalty CDs vs. Traditional CDs

| Feature | No-Penalty CD | Traditional CD |

|---|---|---|

| Interest Rate | Lower (3.40%-4.34%) | Higher (4.00%-4.60%) |

| Early Withdrawal | ✅ No penalty | ❌ Penalty applies |

| Flexibility | ✅ High | ❌ Low |

| Rate Lock | ✅ Yes | ✅ Yes |

How to Choose the Best No-Penalty CD for Your Situation

Step-by-Step Selection Process

1. Determine Your Deposit Amount

- Under $500: Consider Ally Bank or Synchrony Bank (no minimum)

- $500-$1,000: All options available

- Over $1,000: Focus on highest APY options

2. Evaluate Your Timeline

- 6 months or less: Climate First Bank (4.34% APY)

- 7-11 months: Marcus by Goldman Sachs or Ally Bank

- 12+ months: Consider traditional CDs for higher rates

3. Assess Withdrawal Likelihood

- High probability: Prioritize shortest waiting periods

- Low probability: Focus on highest APY options

- Uncertain: Choose middle-ground options with good rates and flexibility

Red Flags to Avoid

- Excessive minimum deposits (over $5,000 for most savers)

- Complex withdrawal restrictions beyond standard waiting periods

- Non-FDIC insured institutions

- Promotional rates that revert to much lower APYs

Opening Your No-Penalty CD: Step-by-Step Guide

Required Documentation

- Government-issued ID (driver’s license or passport)

- Social Security Number or Tax ID

- Proof of address (utility bill or bank statement)

- Initial deposit (check, wire transfer, or ACH)

Application Process

- Research and compare rates using our table above

- Visit bank website or call customer service

- Complete online application (typically 10-15 minutes)

- Fund your account via approved method

- Receive confirmation and account details

- Wait 6-7 days before withdrawal privileges activate

Timeline Expectations

- Application approval: Same day to 2 business days

- Account funding: 1-3 business days for ACH transfers

- Withdrawal access: 6-7 days after funding

- Interest accrual: Begins immediately upon funding

Tax Implications for American and Canadian Savers

US Tax Considerations

- Interest taxed as ordinary income in the year earned

- 1099-INT forms issued for interest over $10

- State tax implications vary by residence

- No special tax advantages compared to other savings vehicles

Canadian Cross-Border Considerations

- US withholding tax may apply (typically 10% under tax treaty)

- Canadian tax reporting required for worldwide income

- Professional consultation recommended for significant amounts

- Currency exchange considerations for CAD conversions

Frequently Asked Questions About No-Penalty CDs

Can I add money to my no-penalty CD after opening?

No, most no-penalty CDs don’t allow additional deposits after the initial funding. If you want to add more money, you’ll need to open a new CD.

How many times can I withdraw from a no-penalty CD?

Most banks allow unlimited withdrawals after the initial waiting period, but some institutions limit withdrawals to once per month or impose other restrictions.

What happens if I withdraw all my money before maturity?

You’ll receive your principal plus any earned interest up to the withdrawal date. The CD will typically close automatically, and you won’t face any penalties.

Are no-penalty CDs better than high-yield savings accounts?

It depends on your priorities. No-penalty CDs offer rate stability and slightly higher APYs, while high-yield savings accounts provide immediate access and the ability to make additional deposits.

Can I open multiple no-penalty CDs?

Yes, you can open multiple no-penalty CDs to create a “ladder” strategy, staggering maturity dates for better liquidity management and potentially higher overall returns.

Expert Strategies for Maximizing No-Penalty CD Returns

The CD Ladder Approach

Strategy: Open multiple no-penalty CDs with different terms

Example:

- $5,000 in 6-month CD at 4.34%

- $5,000 in 11-month CD at 4.00%

- $5,000 in 13-month CD at 3.90%

Benefits: Diversified maturity dates, rate optimization, enhanced liquidity

The Rate Monitoring Strategy

Approach: Open shorter-term no-penalty CDs and monitor rate changes

Execution: If rates increase significantly, withdraw and reinvest at higher rates

Risk Management: Minimal, as you’re protected against rate decreases

The Emergency Fund Optimization

Method: Replace low-yield emergency fund with no-penalty CDs

Implementation: Maintain 1-month expenses in immediate savings, remainder in no-penalty CDs

Result: Higher returns while preserving emergency access

Looking Ahead: No-Penalty CD Outlook for Late 2025

Rate Predictions

Based on Federal Reserve projections and economic indicators:

- Stable rates likely through Q3 2025

- Potential modest decreases in Q4 2025

- Current rates represent good value for rate-locking

Market Opportunities

- New entrants may offer competitive promotional rates

- Credit unions increasingly offering attractive no-penalty options

- Online banks continuing to lead in rate competitiveness

Conclusion: Smart Savings for Uncertain Times

No-penalty CDs represent a compelling middle ground for American and Canadian savers in 2025. With rates up to 4.34% APY and the flexibility to access funds without penalties, they offer an attractive alternative to both traditional savings accounts and restrictive CDs.

Key takeaways for 2025:

- Climate First Bank leads with 4.34% APY on 6-month terms

- Marcus by Goldman Sachs and Ally Bank provide excellent options across multiple terms

- Rate environment favors locking in current rates while maintaining flexibility

- FDIC insurance ensures your principal remains protected

Ready to Optimize Your Savings Strategy?

The current rate environment won’t last forever. Consider opening a no-penalty CD today to secure competitive returns while maintaining the flexibility your financial plan demands.

Next Steps:

- Compare rates using our comprehensive table above

- Calculate potential earnings using online CD calculators

- Research specific bank requirements before applying

- Consider professional consultation for significant deposits

Anderson Silva has dedicated thousands of hours to researching personal finance strategies for everyday Americans and Canadians. Through The Evolving Post, he provides practical insights to help working individuals make informed financial decisions and build lasting wealth.

Important Disclaimer

This article is for educational purposes only and should not be considered personalized financial advice. Interest rates and terms are subject to change. Always verify current rates and terms directly with financial institutions before making deposit decisions. Consider consulting with a qualified financial advisor for advice specific to your individual circumstances.

All banks mentioned are FDIC-insured. CD rates and terms current as of July 2025 and subject to change without notice.

Want to Keep Strengthening Your Finances?

If you found this article helpful, you might enjoy some of our other popular posts that dive deeper into saving, investing, and smart money management:

- 6 Financial Strategies to Protect Your Wealth

- Best High-Yield Savings Accounts 2025

- 8 Powerful Financial Strategies Every Single Person Should Know

- The 10 Best Financial Wellness Apps That Track Mental Health in 2025

- The 10 Best Financial Wellness Apps That Track Mental Health in 2025

- 2025 401(k) Limits: Save $34,750 + Super Catch-Up Guide

Keep exploring — your smartest financial years are just getting started

Sources

- Bankrate.com – CD rates and banking information

- NerdWallet.com – Financial product comparisons

- FDIC.gov – Federal deposit insurance information

- FederalReserve.gov – Monetary policy and economic data

- IRS.gov – Tax implications of interest income

- ConsumerFinance.gov – Consumer banking guidance

- Investopedia.com – Financial education and definitions

- Canada.ca – Canadian tax and banking regulations