Table of Contents

- Introduction

- Understanding Both Debt Payoff Methods

- Why 2025’s High Interest Rates Change Everything

- Real-World Comparison

- When to Choose Debt Avalanche

- When to Choose Debt Snowball

- The Hybrid “Blizzard” Strategy

- Step-by-Step Implementation Guide

- Common Mistakes to Avoid

- FAQ

- Conclusion

Introduction

Back in repayment mode and unsure which debt-crushing strategy makes sense this year? You’re not alone. With average U.S. credit card APRs hovering near 22% — the highest in decades according to the Federal Reserve G.19 report — every extra month in debt costs you significantly more than ever before.

The stakes have never been higher for choosing the right debt payoff strategy. An avalanche approach (tackling the 22% card first) saves more interest than ever, but the snowball method isn’t dead: it still wins on motivation, especially when balances feel overwhelming.

For American and Canadian consumers drowning in high-interest debt, understanding which method works best for your specific situation could save you thousands of dollars and months of payments in 2025.

Understanding Both Debt Payoff Methods

What is the Debt Snowball Method?

The debt snowball method prioritizes paying off your smallest balances first, regardless of interest rate. You make minimum payments on all debts while throwing every extra dollar at the smallest balance until it’s eliminated.

How the Snowball Method Works

According to financial institutions and debt management experts, the basic process involves:

- List all debts from smallest to largest balance

- Pay minimums on everything except the smallest debt

- Attack the smallest debt with all extra money

- Once paid off, roll that payment to the next smallest debt

- Repeat until debt-free

What is the Debt Avalanche Method?

The debt avalanche method prioritizes paying off your highest interest rate debts first, regardless of balance size. This mathematically optimal approach minimizes total interest paid over time.

How the Avalanche Method Works

- List debts from highest to lowest interest rate

- Pay minimums on everything except the highest-rate debt

- Attack the highest-rate debt with all extra money

- Once paid off, roll that payment to the next highest-rate debt

- Repeat until debt-free

Quick Comparison Table

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Priority | Smallest balance first | Highest interest rate first |

| Main Benefit | Quick psychological wins | Maximum interest savings |

| Best For | People needing motivation | Math-driven, disciplined savers |

| Total Interest | Higher | Lower |

| Time to First Win | Faster | Slower |

Why 2025’s High Interest Rates Change Everything

The Current Rate Environment

Credit card interest rates in 2025 are brutal:

- Average APR: 22% (highest in decades)

- Store cards: Often 26-29% APR

- Premium rewards cards: 24-28% APR

- Student credit cards: 20-24% APR

The Math Behind High-Rate Impact

With rates this high, every extra month in debt is expensive. Here’s what 22% APR means in real dollars:

- $5,000 balance: Costs $91.67 per month in interest alone

- $10,000 balance: Costs $183.33 per month in interest alone

- $20,000 balance: Costs $366.67 per month in interest alone

Why Avalanche Wins More Often in 2025

The higher the interest rates, the more the avalanche method saves. With 2025’s elevated rates, the mathematical advantage of avalanche over snowball has increased significantly compared to previous years when rates were lower.

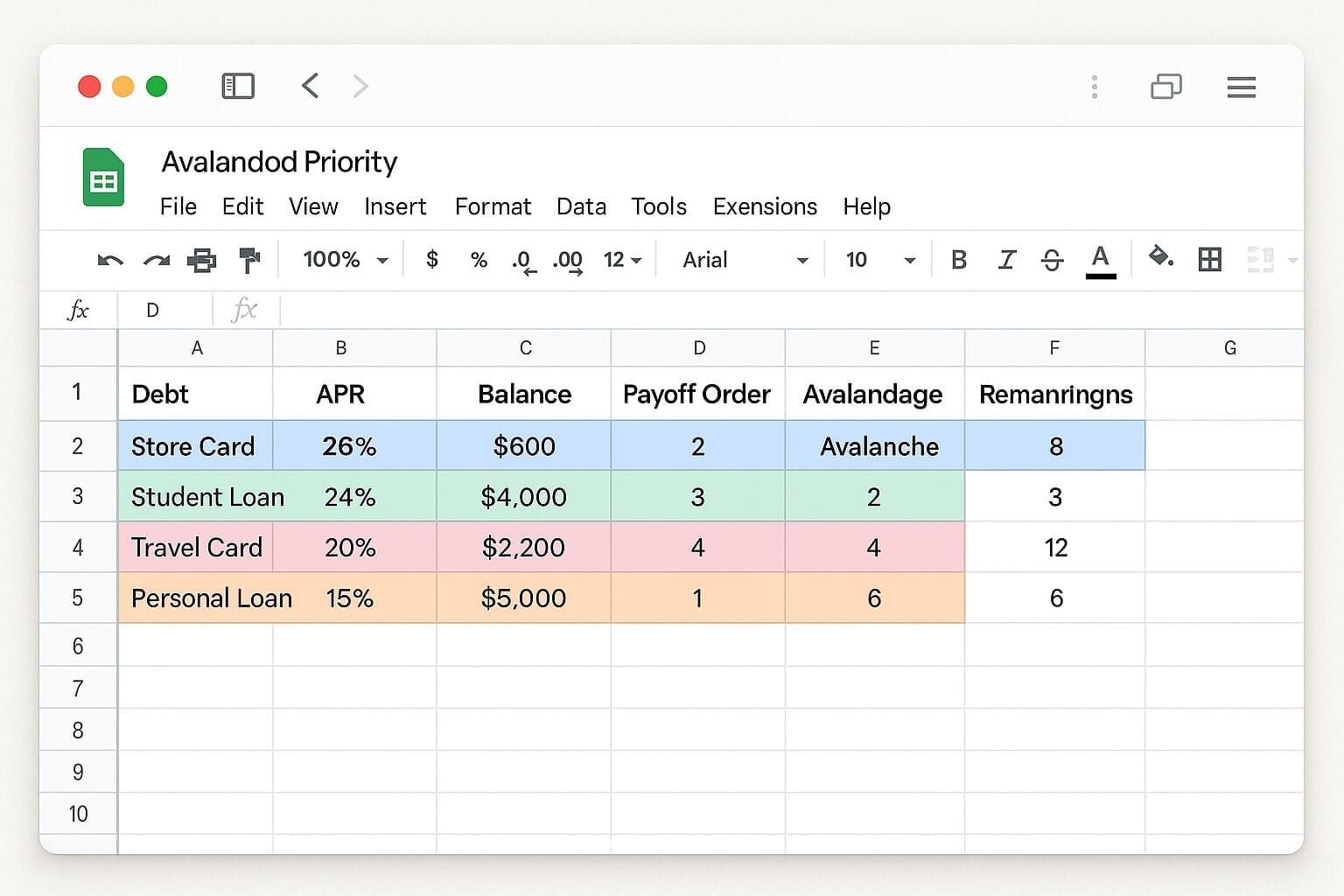

Real-World Comparison

The Debt Portfolio Example

Let’s examine a typical 2025 debt scenario to see the real impact of each method:

| Card | Balance | APR | Minimum Payment |

|---|---|---|---|

| Store Card | $400 | 26% | $25 |

| Travel Card | $3,200 | 19% | $80 |

| Student Card | $6,400 | 24% | $160 |

| Premium Rewards | $10,000 | 28% | $250 |

Total Debt: $20,000

Extra Payment Budget: $150/month

Snowball Method Results

Order of payoff: Store Card → Travel Card → Student Card → Premium Rewards

- Time to debt-free: 38 months

- Total interest paid: $6,900

- First debt eliminated: 2 months (Store Card)

Avalanche Method Results

Order of payoff: Premium Rewards → Store Card → Student Card → Travel Card

- Time to debt-free: 34 months

- Total interest paid: $5,100

- First debt eliminated: 15 months (Premium Rewards)

The Bottom Line

Avalanche saves approximately $1,800 and 4 months — but only if you stay motivated without the quick win of clearing that $400 store card first.

When to Choose Debt Avalanche

You’re a Good Candidate for Avalanche If

You Have High-Interest Debt (21%+ APR)

With 2025’s elevated rates, the interest savings from avalanche are more substantial than ever. If most of your debt carries rates above 21%, avalanche typically saves significant money.

You’re Numbers-Driven and Disciplined

Avalanche requires patience and discipline. You need to stay motivated for potentially 12+ months before seeing your first debt disappear completely.

You Can Delay Gratification

If you’re comfortable working toward long-term goals without frequent rewards, avalanche’s delayed but substantial payoff works well.

Avalanche Success Stories

Marcus, a 29-year-old software engineer from Toronto, had $15,000 in credit card debt across three cards with rates of 19%, 24%, and 27%. By focusing on the 27% card first, he saved $2,100 in interest compared to the snowball method and became debt-free 6 months sooner.

When to Choose Debt Snowball

You’re a Good Candidate for Snowball If

Debt Balances Overwhelm You Emotionally

If looking at your debt totals causes anxiety or paralysis, snowball’s quick wins can provide the emotional boost needed to stay committed.

You Need Frequent “Wins” to Stay Engaged

Some people require regular positive reinforcement. If you’re motivated by checking items off a list, snowball’s frequent victories keep you engaged.

Your Highest-APR Debt Is Small

If your highest-rate debt happens to also be one of your smaller balances, the cost difference between methods shrinks significantly.

Snowball Success Stories

Jennifer, a 34-year-old teacher from Phoenix, had seven different debts totaling $18,000. The avalanche method felt overwhelming, but snowball helped her eliminate three debts in the first six months, giving her the confidence to stick with the plan and become debt-free in 32 months.

The Hybrid “Blizzard” Strategy

Best of Both Worlds Approach

Not ready to choose? Try a “Blizzard” approach that combines both methods:

Phase 1: Mini-Snowball (1-3 months)

- Start by paying off one small balance fast for a confidence boost

- Choose a debt under $1,000 if possible

- Experience the psychological win of eliminating a debt completely

Phase 2: Switch to Avalanche

- After your first success, switch to avalanche mode

- Apply the freed-up payment to your highest-rate debt

- Continue with avalanche for all remaining debts

Blizzard Method Benefits

- Immediate motivation from quick win

- Long-term savings from avalanche approach

- Reduced overwhelm from simplified debt list

- Flexibility to adjust based on what works

Step-by-Step Implementation Guide

Step 1: Complete Debt Inventory

Gather Information for Every Debt

- Current balance

- Interest rate (APR)

- Minimum monthly payment

- Payment due date

- Account numbers and contact information

Include All Debt Types

- Credit cards

- Personal loans

- Store financing

- Buy-now-pay-later (BNPL) accounts

- Student loans (if not in deferment)

Step 2: Calculate Your Extra Payment Capacity

Review Your Budget

- Total monthly income after taxes

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (groceries, gas, entertainment)

- Current minimum debt payments

Find Extra Money

- Reduce discretionary spending temporarily

- Use windfalls (tax refunds, bonuses, gifts)

- Consider side income opportunities

- Reallocate money from savings (keep small emergency fund)

Step 3: Choose Your Method and Create Your Plan

For Debt Avalanche

- List debts from highest to lowest APR

- Commit extra payments to highest-rate debt

- Set up automatic payments for all minimums

- Track progress monthly

For Debt Snowball

- List debts from smallest to largest balance

- Commit extra payments to smallest debt

- Set up automatic payments for all minimums

- Celebrate each debt elimination

Step 4: Automate and Track Progress

Set Up Automatic Payments

- All minimum payments on auto-pay

- Extra payment to target debt

- Prevents late fees and missed payments

Track Your Progress

- Monthly balance updates

- Interest saved calculations

- Debt-free date projections

- Celebrate milestones

Common Mistakes to Avoid

Spreading Extra Payments Across All Debts

The Problem: Paying a little extra on everything slows progress significantly.

The Solution: Focus all extra money on one target debt while paying minimums on everything else.

Not Accounting for Promotional Rates

The Problem: Ignoring 0% promotional periods that will end soon.

The Solution: Prioritize debts with ending promotional rates, regardless of your chosen method.

Stopping When You Hit a Setback

The Problem: One missed month or unexpected expense derails the entire plan.

The Solution: Build small setbacks into your timeline and restart immediately after any interruption.

Not Adjusting for Rate Changes

The Problem: Credit card rates can increase, changing your optimal strategy.

The Solution: Review and adjust your plan every 6 months or when rates change significantly.

Ignoring Minimum Payment Changes

The Problem: As balances decrease, minimum payments also decrease, reducing your momentum.

The Solution: Keep paying the original minimum amount even as required minimums drop.

FAQ

Can I switch methods partway through?

Yes, you can switch from snowball to avalanche or vice versa at any time. Many people start with snowball for motivation and switch to avalanche after eliminating a few small debts.

What if my highest-rate debt has the largest balance?

This scenario strongly favors the avalanche method, as you’ll save the most interest. However, if the balance feels overwhelming, consider the blizzard approach: eliminate one small debt first, then tackle the high-rate debt.

Should I include my mortgage in debt payoff planning?

Generally no. Mortgages typically have much lower rates than credit cards and offer tax benefits. Focus on high-interest consumer debt first, then consider extra mortgage payments.

How do I handle promotional 0% APR periods?

Prioritize debts with ending promotional periods regardless of your chosen method. A 0% rate that becomes 24% in three months should be your top priority.

What if I can’t afford the minimum payments?

If you can’t make minimum payments, contact creditors immediately to discuss hardship programs. Consider credit counseling services before your situation worsens.

Conclusion

The best debt payoff strategy isn’t the one that looks perfect in a spreadsheet — it’s the one you can stick with for 30+ months until every last balance hits zero. In 2025’s high-rate environment, both methods beat minimum payments only, which could more than double your interest costs over time.

Key takeaways for 2025:

- Avalanche saves more money with today’s high interest rates

- Snowball provides better motivation for those who need quick wins

- Blizzard method offers a compromise between savings and psychology

- The fastest method is the one you start this week

Your Next Steps

- Complete your debt inventory using our step-by-step guide

- Calculate potential savings with both methods

- Choose the approach that matches your personality and situation

- Set up automatic payments to prevent missed payments

- Start immediately — every day of delay costs money

Ready to Accelerate Your Debt Freedom?

The current high-rate environment makes debt elimination more urgent than ever. Whether you choose avalanche, snowball, or blizzard, the most important step is starting today.

Anderson Silva has dedicated thousands of hours to researching personal finance strategies for everyday Americans and Canadians. Through The Evolving Post, he provides practical insights to help working individuals make informed financial decisions and build lasting wealth.

Important Disclaimer

This article is for educational purposes only and should not be considered personalized financial advice. Debt situations vary significantly, and what works for one person may not work for another. Consider consulting with a qualified financial advisor or credit counselor for advice specific to your individual circumstances.

Want to Keep Strengthening Your Finances?

If you found this article helpful, you might enjoy some of our other popular posts that dive deeper into saving, investing, and smart money management:

- 6 Financial Strategies to Protect Your Wealth

- Best No-Penalty CD Rates of 2025

- Best High-Yield Savings Accounts 2025

- 8 Powerful Financial Strategies Every Single Person Should Know

- The 10 Best Financial Wellness Apps That Track Mental Health in 2025

- The 10 Best Financial Wellness Apps That Track Mental Health in 2025

- 2025 401(k) Limits: Save $34,750 + Super Catch-Up Guide

- FAFSA Changes 2024–2025: What Students and Families Need to Know

Keep exploring — your smartest financial years are just getting started.

Sources

- Wells Fargo. “What to know about the debt snowball vs avalanche method.”

- Investopedia. “Debt Snowball Method: How It Works to Pay Off Debt.”

- NerdWallet. “Debt Avalanche vs. Debt Snowball: What’s the Difference?”

- Federal Reserve. “Consumer Credit – G.19.”

- Bankrate. “Debt avalanche vs. debt snowball: Which strategy is better?”

- Credit Karma. “Debt avalanche vs. debt snowball: Which is better?”

- Capital One. “The Debt Snowball Method.”

- The Balance. “Debt Snowball vs. Debt Avalanche: Which Is Better?”

- Experian. “Debt Snowball vs. Debt Avalanche: Which Should You Choose?”

- Consumer Financial Protection Bureau. “What is a debt-to-income ratio?”

- National Foundation for Credit Counseling. “Debt Management Plans.”